Public policy has a significant role in how a city develops. Policies are shaped by public stakeholders, interest groups, politicians and local community boards; and they are enforced by government agencies. This section outlines prominent agencies, regulations and incentives that directly affect and oversee real estate development in New York City. A majority of the information provided focuses on residential and multifamily development, as housing is the most regulated sector of real estate. Commercial (office and retail) and industrial development is mostly controlled by zoning and land use law as previously discussed in Sections II A and B.

New York State and New York City Development Agencies

While New York City has an “as of right” building policy3, there are federal, state and city agencies that oversee new development, preservation and sustainability of the City’s buildings and neighborhoods. Some of these agencies are named and profiled in further detail in this section. Contact information is also provided for each of the agencies, as well as details about how to gather information about the actions and policies of a particular agency that may relate to a prospective development site or project. A full list of New York City agencies that specifically oversee housing and development can be found at the following link of the City of New York’s website:

http://www1.nyc.gov/nyc‐resources/agencies.page

We have selected a few specific agencies that are particularly active in the financing and regulation of new developments and preservation projects in the five boroughs. These agencies may have encumbrances on properties, and their approval may be required for the sale of a specific property. Furthermore, these agencies may be responsible for interim ownership and transfer of title of blighted and foreclosed properties throughout the City. They are in essence the “owner” of many sites throughout the City, and take on the role of financier and partner of many private and not‐for‐profit developers. Valuable financing and subsidy programs are provided and administered by these agencies, and may be imperative to the success and feasibility of a project. The term “public‐private partnerships” is often thrown around in regards to urban development and revitalization. It is precisely these agencies that comprise the “public” side of such a partnership. They offer financial incentives to private developers and real estate owners to encourage them to invest private capital and resources in community development and rehabilitation projects. It is, therefore, imperative to understand the role that development agencies play and how to navigate them when considering the acquisition or development of specific NYC sites.

US Department of Housing and Urban Development (HUD)

HUD is a federal agency that distributes funding in the form of mortgage financing and rental subsidy to each of the fifty states. The states then allocate these public monies to developers and their individual residential projects. Each state housing agency has their own application process and scoring system to determine how funds are allocated. Funding for HUD programs is determined by the federal budget. The agency has regional offices that oversee a specific geography, or “catchment area”. A list of the regional HUD offices and their respective Directors can be found on the HUD website:

https://portal.hud.gov/hudportal/HUD?src=/program_offices/field_policy_mgt/localoffices#NY.

New York State Homes and Community Renewal (HCR)

This agency is responsible for allocating and managing HUD funding to the state of New York, and project management for the construction and preservation of affordable housing. HCR is further divided into five separate divisions:

- HCR Division of Housing and Community Renewal (DHCR)

- HCR Housing Trust Fund Corporation (HFTC)

- HCR Housing Finance Agency (HFA)

- HCR State of New York Mortgage Agency (SONYMA)

- HCR Affordable Housing Corporation (AHC).

HCR and its subdivisions are important to become familiar with should an owner/developer pursue the development or acquisition of multifamily or SFR rental housing in NYC. Property site research may reveal that one of these agencies is a mortgagor of the property. Often times, HFA and SONYMA loans are assumable for future buyers. Alternatively, the mortgage may have an accompanying Regulatory Agreement that encumbers the property, and may require agency approval to sell.

SONYMA has a first‐time homebuyer loan product to promote homeownership that requires minimal down payment and boasts a low interest rate. There are a variety of similar incentive programs and loan products to promote residential acquisitions by New Yorkers. While some of these are reserved for primary residences, others can be used to purchase a single family or townhome rental property. These programs originate and evolve over time. For the most up to date program information, always refer to the HCR homeownership and rental owner links (below).

New York City Housing Development Corporation (HDC) & New York City Housing Preservation and Development (HPD)

HDC and HPD function in a similar capacity. They are both financing and development corporations that fund and oversee the construction and preservation of multifamily housing in NYC. HDC was created by the New York State Legislature in 1971 as an alternative means of supplying financing for affordable and mixed income housing separate from the City’s capital budget. Flexibility was built into the agency’s mission, and it has amended its tools and resources over time to now include the issuance of bonds and low‐cost loans, and a variety of subsidy programs to develop and preserve housing.

HPD was established in 1978, and operates in a similar capacity as HDC, with additional responsibilities of compliance monitoring, management and regulation of the City’s housing stock. HPD oversees city government programs to reach specific housing targets (ie Mayor Bill De Blasio’s Housing New York Plan: 200,000 affordable housing preserved or constructed units in ten years). HPD is often a partner of developers and community organizations to ensure that these projects are feasible and in compliance with the City’s neighborhood planning initiatives. Some of the unique functions and development resources offered by HPD include: tax abatements, issuance of tax credits and low‐interest loans. The agency participates in oversight of its projects through issuance of fines and penalties to owners for failure to maintain compliant and up‐to‐code housing. In this manner, HPD is a tenant advocate, proactive neighborhood planner, and ultimately ensures quality, not just quantity, of housing for New Yorkers.

Like most community development agencies, HDC and HPD originate projects through a Request for Proposal (RFP) process. RFP links are available for both agencies.

HDC RFP Link: http://www.nychdc.com/Current%20RFP

HPD RFP Link: http://www1.nyc.gov/site/hpd/developers/rfp‐rfq‐rfo.page

City owned land and foreclosed properties with City mortgages fall under the jurisdiction of these two agencies. An agency may issue an RFP for developer proposals for the new development or redevelopment of a blighted property. The requirements and selection criteria are published in the RFP and made available to the public. The overseeing agency establishes a list of qualified developers to acquire these sites, and to develop them per the agency’s specifications. Through a public‐private partnership structure, the agency assists the developer with assembling the capital stack to realize a feasible and profitable project. The next section discusses public policy in the form of legislation and initiatives that incentivize developers to build in‐demand assets; in New York City, this is almost always housing.

New York City Development Incentives

Development incentives are imperative to successful city planning. These incentives provide financial justification for a developer to construct a property that may not necessarily be best and highest use, or one that may accommodate reduced income units (ie affordable or supportive housing). It allows the City to have an active role in creating and maintaining vibrant and diverse communities. This section will briefly discuss some of the major tax‐related incentive programs, as well as 80/20 developments which allow owners to build beyond as‐of‐ right square footage per zoning and floor to area ratio (FAR). As a potential investor or developer in an 80/20 project, or one that has received special tax treatment, it is important to understand the mechanism in place and how it will affect future property tax rate assumptions. It may also become necessary to be in open communication with the City to maintain or extend tax exempt status for a property after you have acquired it.

Tax‐Exemptions: 421a and J51

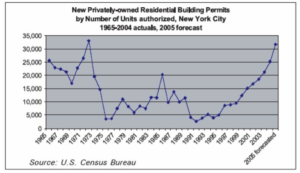

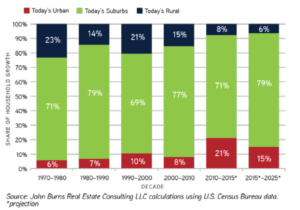

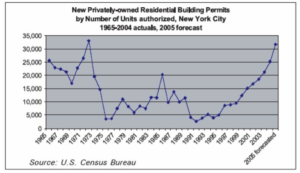

The 421a program offered developers a ten‐year tax abatement if they opted to develop multifamily housing on a vacant site. The program originated through the NY State Legislature in 1971. The impetus for this program, amongst others, was to encourage developers to create more housing options throughout the five boroughs for New Yorkers. During the construction period, developers paid no tax (up to three years), which was followed by a ten‐year tax abatement period which reduced by 20% every two years until expiration ten years out. There are several variations of the 421a program that offer additional benefits to owners that develop partially or entirely affordable housing projects, as well as those that convert commercial spaces to residential. The program expired in 2015 with no alternative or renewal in place. At the time this paper was written (Spring 2017), the new 421a Bill was still being debated by state legislature. Debated additions to the Bill include modifying the applicable zones for the program, as well as a contentious requirement for union wages.8 Per the below diagram, it is clear that the program was an effective tool to encourage new housing development through the eighties, nineties and early 2000s. More information regarding properties that receive special tax treatment per 421a, and about the evolving revision of the Bill can be found on the New York City website:

http://www1.nyc.gov/site/finance/benefits/benefits‐421a.page

Similar to 421a, J51 is a New York City tax abatement program for owners and developers of multifamily residential. However, J51 is and as‐of‐right program that is specific to the rehabilitation (not new construction) of aging and blighted rental housing in the five boroughs. HPD is the agency that determines a project’s eligibility for a J51 exemption and administers the program over the term of the exemption. In exchange for the providing this benefit to ownership, HPD requires that the units be rent stabilized throughout the period of the tax exemption.10 As previously discussed in Section I B, property searches will indicate if a property receives this tax benefit. The City also makes this information available to the public via a compiled and updated list of J51 properties found at the below site:

http://www1.nyc.gov/site/finance/benefits/benefits‐j51.page.

The program includes two benefits: 1) The exemption reduces the taxable assessed value of a property (which is the basis for calculating real estate tax), and 2) The exemption reduces the actual tax that has been charged against a property.11 The duration of a J51 tax exemption is ongoing, so long as the rental units remain rent stabilized and compliant with HPD program requirements. As these programs are evolving over time, it is important to refer to the NYC City website for the most up‐to‐date specifics regarding Tax Incentives:

http://www1.nyc.gov/site/hpd/developers/tax‐incentives.page.

80/20 Multifamily Housing Developments

80/20 Developments are not unique to New York City, and exist throughout the nation. This development program has become a widely popular and successful means of incentivizing developers to construct desperately needed affordable housing throughout American’s cities and suburbs. In New York City, a developer is able to build beyond the maximum square footage as defined by zoning and FAR for a lot if the project will be housing that offers 80% market‐rate units, and 20% affordable housing units.12 In addition to the ability to build additional rentable square footage, HFA offers tax‐exempt financing for 80/20 developments to help create a feasible project. HFA will require the owner to enter a Regulatory Agreement that will assure rent regulation and compliance for the affordable component. Furthermore, if 80/20 developments are built in specific districts of NYC, additional tax incentives may be available through the City. These developments may take the form of a public‐private partnership to redevelop City owned land and revitalize a neighborhood (ie Battery Park City).

There are a variety of tax‐exempt financing options available for the development and preservation of affordable housing that warrant a discussion beyond the scope of this report. The key takeaway is that when acquiring or developing residential projects in New York City, it is imperative to understand the financing terms, requirements and restrictions of a project, as well as any compliance related matters (related to tenant income and rental rates) should a project have an affordable component. This information is readily available through property searches and City agency websites. The HCR website offers an exhaustive list of the various financing programs available and details their accompanying tax incentives:

http://www.nyshcr.org/Topics/Developers/MultifamilyDevelopment/.