Why it is important?

Besides the population growth, there are some factors impact real estate demand, such as relocation.

One of the most common reason is retirement. The traditional labor pool of the working-age population 20–64 will grow much more slowly over the next decade, which means slower job growth and rising wages. From ULI data, the retirement surge over the next decade means that by 2025, the number of people leaving the labor pool (the total number of people ages 20–64) will almost equal the number entering it. ULI also predicts Household growth over the next decade will tilt heavily south, toward the “affordable sunshine states” of the Sun Belt: Florida, Texas, the Southeast, and the Southwest. So the retirement indicators are significant in relocation and senior housing/Health Care research.

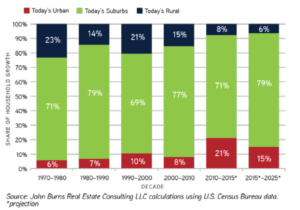

Returning suburban growth is one of the relocation trends. Urban areas, which tend to have less room to build, higher prices, and fewer desirable schools, will capture 15 percent of household growth, modestly boosting cities’ share of the total number of households. Many suburban cities created decades ago that are now largely built out continue to reinvigorate themselves with vibrant suburban downtowns composed of new retail and residential developments. In suburban areas, home size, privacy, housing affordability, and kid-friendliness feel more urban than suburban, while school quality, public transportation, and proximity to employment feel more suburban. Because both cities and consumers want retail that is walkable from housing, retail and residential developers should work closely to create cohesive developments to satisfy this evolving consumer. An 86 percent surge in household formations to 12.5 million households over the coming decade in comparison with the prior decade will drive purchases in all stores that cater to new households, particularly renters, who will constitute 58 percent of the net new number of households.

Another relocation trend is the shift to sharing and experience economy. The new sharing economy, which includes more opportunities to rent or borrow than ever before, will most certainly affect household formation and spending patterns. The well-known examples are Airbnb and WeWork, which hit the hotel market and traditional office market representatively.

Strengthens/ Weakness

While these trends are still in the process, so it might be difficult to track timely in research.

Resources

Information for these relocations can be obtained in Urban Land Institute.