Interest Rate

Why it is important?

Continued to the previous economic indicators, capital cost is also a major concern for real estate investment. The most direct indicator is the interest rate which is critical in the finance and evaluation of any investment primarily because of their impact on the present value of future cash flows and current mortgage. When the interest rates go up, the monthly payment increases and the value of any future cash flow decreases, which in turn lowers the value of the asset.

Strengthens/ Weakness

However, interest rates never change alone, so it is useless to analyze the potential effects on real estate value without thinking about the other factors that may occur in tandem with changing rates.

Resources

Interest Rates are various from lenders, where we may get information directly. But the most common one is the Federal Funds Rate which can be obtained from Federal Reserve. There are also some prime rates can be reliable references, such as WSJ Prime Rate or LIBOR.

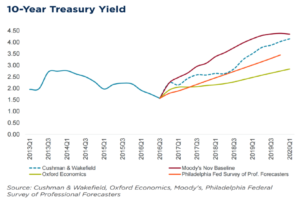

10-year treasury yield

Why it is important?

Another indirect indicator – 10-year treasury yield is also drawing attention from investors and researchers. And treasury yields are related directly to mortgage interest rates, which affect home buying and refinancing decisions. Usually, treasury bonds are benchmarks for mortgage and other loan rates because they are risk-free assets. There is a strong correlation between mortgage interest rates and Treasury yields, according to a plot of 30-year conventional mortgages and 10-year Treasury yields using Federal Reserve Economic Data. The other reason 10-year treasury yield became an economic indicator in real estate is because many investors have been laser-focused on how a rise in US Treasury rates could trigger a rise in cap rates, and therefore a fall in real estate values.

Strengthens/ Weakness

Upon Morgan Stanley’s technical analysis, the correlation between cap rates and Treasury rates turns out to be tenuous. This suggests that other key variables may influence cap rate movements and real estate which need a deep exploration.

Resources

For 10-year treasury yield, most finance websites (e.g. yahoo, Cushman & Wakefield, Oxford Economics, Moody’s) can offer accurate information.

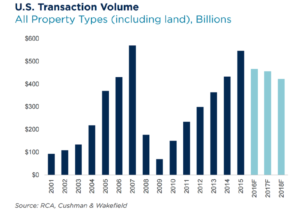

Investment Sales

Why it is important?

From the perspective of market volume, investment sales can indicate the dynamic in the real estate market which including office, retail, industrial, multifamily, hotel and lands. While the peak year of sales activity in this cycle was 2015 (at $546.3 billion), it never surpassed the previous peak year of 2007 ($569.9 billion). This was a function of many factors, including pre-election jitters along with a sharp move upwards in Treasury yields which had many investors pausing and recalibrating. Key players are also a part of this indicator. Like the largest players in the market—private equity and institutional investors—grew their investments in commercial real estate modestly in 2016. These two types of buyers accounted for more than 70% of asset purchases. So this indicator can help researcher or investors forecast the next quarter or year, also track the major player in the market.

Strengthens/ Weakness

But for any specific type of real estate or area, the total investment sales cannot help with identifying the internal changes and future trends.

Resources

While the total volume of investments sales can be obtained from RCA, NCREIF, Moody’s Analytics and other major real estate or finance consulting websites.

Industries Indicators

To solve the problem of internal changes, it is necessary to track related industries to see how it influence real estate market. And it also shows the economic structure which could be healthy or unhealthy, traditional or innovative.

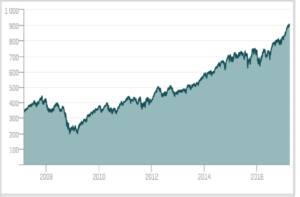

Technology

Why it is important?

The first industry indicator could be technology. Silicon Valley is a typical example which can refer to all high-tech businesses in the region. The term is now generally used as a synecdoche for the American high-technology economic sector and became a global synonym for leading high-tech research and enterprises. In real estate, it is also like a landmark which developed and boomed with technologies. So this area has an innovation and advanced economic structure, and it would definitely attract investors or developers to create spaces for them to live, work and shop.

Strengthens/ Weakness

There are some major indexes can be indicators for the technology industry, like the S&P 500 Information Technology Index, which comprises those companies included in the S&P 500 that are classified as members of the GICS information technology sector. The tendency is remaining positive, but this indicator is too generic like GDP, only shows a simple impression. For a specific research, there would need a more statistics analysis for technologies companies.

Resources

S&P 500 or NASDAQ can offer industry indexes which are more reliable and updated.

Retail

Why it is important?

With the rapid growth of Information Technology, there is another topic – E-Commerce which is often brought up to compare with traditional retail. For the whole retail industry, consumer spending growth is an important indicator for researcher and investors to evaluate the whole market performance. In 2016, retail closures and bankruptcies were up significantly, and over 4,000 major chain closures were tracked, a figure that surpassed 2010’s record 3,600 shuttered major chain storefronts. In addition, there were 26 major U.S. retailer bankruptcies during 2016 compared to 22 in both 2015 and 2014. Therefore, a few major retail categories will be contracted, while other sectors that have been growing will increasingly face issues of market saturation that will slow expansion. Contraction from department store chains and high-profile apparel in 2017 will mostly impact mall and lifestyle center properties. However, the anticipated atmosphere of uncertainty may negatively impact publicly traded brands beyond those categories. On the whole, neighborhood/community and power centers will perform best with the least exposure to contraction, while the impact of these trends on mall and lifestyle centers will be disproportionately felt by Class B and C properties, particularly those in secondary or tertiary markets. Although this information is not direct with the retail tenants or landlords, it can impact investors’ decision and the retail real estate market from its rent, absorption and vacancy. In this case, retail sales should be an indicator to reflect the changes in traditional retail market.

Strengthens/ Weakness

However, with a larger share of that spending going to eCommerce. This indicator only can reflect consumers’ buying power, but cannot be analyzed for traditional retail or e-commerce.

Resources

Cushman & Wakefield and similar real estate service companies offer detailed reports for retails and shopping centers by locations.

E-Commerce

Why it is important?

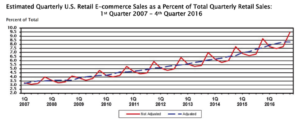

Like mentioned before, a large share of retail sale is going to eCommerce. With that said, the demand of warehouses and distribution centers will increase, then industrial real estate will continue to benefit from this growth. So the eCommerce sales can be another industry indicator.

Strengthens/ Weakness

But due to its limitations, it may only apply to specific research in industrial real estate.

Resources

E-commerce sales information can be obtained from US Department of Commerce.

ISM Manufacturing Index

Why it is important?

There is another commonly used industry indicator for research in industrial real estate — ISM Manufacturing Index. The ISM manufacturing index is based on surveys of 400 purchasing managers nationwide regarding manufacturing in 20 industries. The index has a strong correlation with manufacturing industrial production and provides timely information on manufacturing.

Strengthens/ Weakness

The ISM index is also a good leading indicator of the economy and is useful in gauging turning points in the business cycle. However, ISM index does not capture technological change and production efficiencies, which make it possible for production to expand while employment contracts.

Resources

ISM Index, as a common index industrial business, can be obtained from Institute for Supply Management directly or related industrial reports.